I have had the privilege to share our knowledge and expertise on FIRPTA for over 3 years now, yet some title professionals still take upon themselves liability and obligations that, frankly, they shouldn't.

When a foreign person sells U.S. real estate, the Foreign Investment in Real Property Tax Act (FIRPTA) is a critical component of the transaction. However, there's often a misconception about who is responsible for withholding the required tax, we want to clarify this crucial point for all parties involved in a real estate transaction.

The Title Company is Not the FIRPTA Withholding Agent

It is a common misunderstanding that the title company or settlement agent is the withholding agent for FIRPTA. This is incorrect. Under U.S. law, the responsibility for withholding and remitting the tax falls squarely on the transferee-in a typical real estate transaction, this is the BUYER.

The Internal Revenue Code is clear on this matter. According to 26 U.S. Code § 1445, the transferee (buyer) is the one "required to deduct and withhold a tax equal to 15 percent of the amount realized on the disposition." While a settlement officer or title agent often facilitates the process by issuing the check and sending the funds to IRS, they are NOT the withholding agent.

The IRS Code further clarifies that a person is not treated as a transferor's or transferee's agent "merely because such person performs 1 or more of the following acts:

(A) the receipt and the disbursement of any portion of the consideration for the transaction, (B) the recording of any document, and

(C) the furnishing of a closing statement."

This exemption from liability for settlement officers performing these clerical duties is crucial.

Why a Licensed Tax Professional is Essential

FIRPTA is a complex area of tax law with specific exemptions, reduced withholding rates,

It is always in the best interest of both the buyer and the foreign seller to consult with a licensed tax professional, such as an Enrolled Agent, or tax attorney, who is well-versed in FIRPTA. A qualified professional can:

- Help seller and buyer understand their obligations and potential liabilities.

- Ensure that all forms, such as Form 8288 and Form 8288-A, are completed accurately and filed on time.

- Applying for a U.S. tax ID for the seller.

- Assisting in recovering FIRPTA deposit.

By working with a licensed tax professional with expertise in FIRPTA matters, all parties can navigate the complexities of FIRPTA with confidence and ensure compliance with federal tax law.

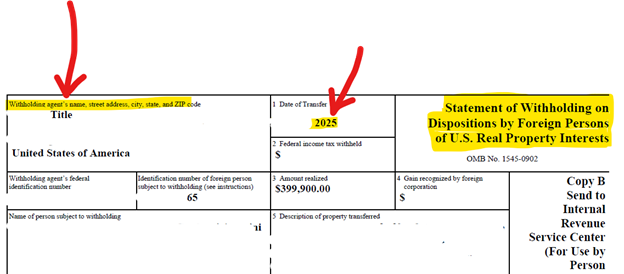

PLEASE DO NOT DO THIS!!

(this was sent to us yesterday, I am glad we were able to correct this mistake and make FIRPTA easy for everyone involved)

------------------------------

Mary Enzi CAA

Tax Solutions – FIRPTA Consulting

[email protected]+1 (281) 578-1040

Office Manager

Katy TX

------------------------------