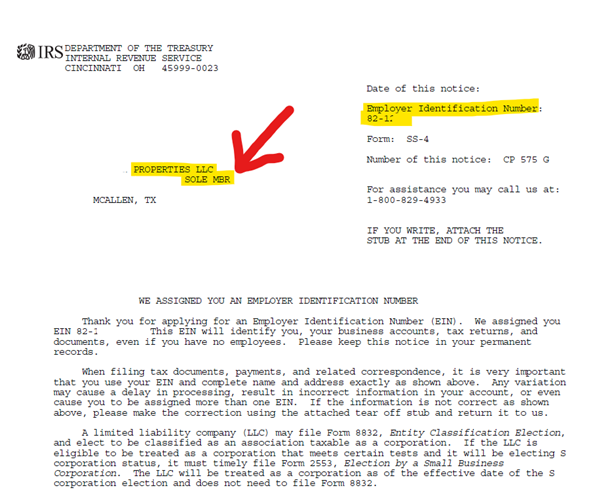

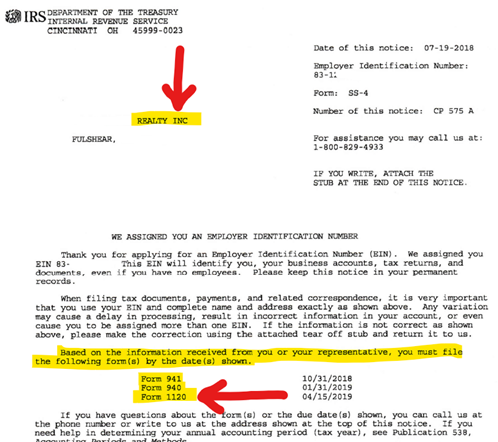

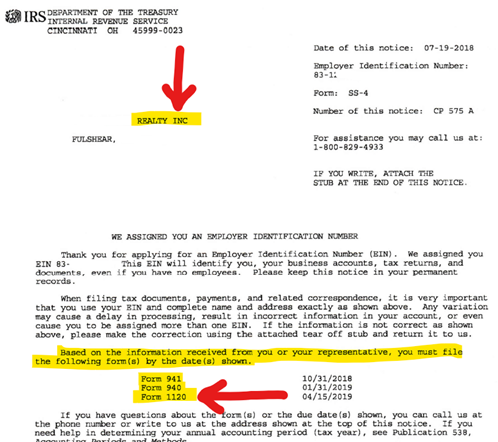

In my last post about the different types of LLC's and FIRPTA,I included a screenshot of the SS4 so you can look at it but apparently I did not post because I received calls asking me how does the IRS SS-4 look like, here they are again, hopefully you can see them this time. Otherwise send me an email I will send them to you.

A Sole member LLC, is a disregarded entity meaning, if the owner is a foreign individual FIRPTA applies to the owner of the single member LLC, if the LLC or corporation files its own tax return as you can see on the other screenshots, then the corporation has to withhold FIRPTA to the foreign partner or shareholder, withholding is not done at the time of closing, if you have any questions let me know.

------------------------------

Mary Enzi CAA

Tax Solutions – FIRPTA Consulting

[email protected]+1 (281) 578-1040

Katy TX

------------------------------