If you have FIRPTA questions, please call us, we are happy to answer your FIRPTA questions and if you say you saw us here on ALTA, there is no charge for answering your FIRPTA questions.

Original Message:

Sent: 08-10-2023 12:02

From: Dee Harrison

Subject: FIRPTA - Thank you for all your calls - Keep them coming!!

Hi Mary - Thanks for the post on FIRPTA. When i close a transaction, most of my clients hire a FIRPTA CPA who files for the IRS waiver. Once the receive the letter from IRS with the breakdown, i then (withing 20 days of the letter), release the portion to IRS and the difference to the seller. Is this ok?

------------------------------

Dee Harrison

Alpha Reliable Title, Inc

Orlando FL

Original Message:

Sent: 08-09-2023 16:23

From: Mary Enzi

Subject: FIRPTA - Thank you for all your calls - Keep them coming!!

Hello!!

I want to follow up on the importance of TIMING in the FIRPTA world, we just recently talked to an Escrow at a Title Co. who identified the foreign seller and made the appropriate withholding on the closing date, great! However, the Title Company kept the money and the FIRPTA compliance forms and did not send it to the IRS, thankfully, he is a very smart guy, has read my FIRPTA posts in ALTA Forum and gave us a call, we talked to him and gave him instructions as to what to do, how and where to send the check and forms, etc.... this all happened on day 19 after the closing.

REMEMBER, FIRPTA withholding has to be sent within the 20 days after the closing, otherwise the buyer can get penalized for "not complying with the FIRPTA rules" do not forget, foreign seller is subject to the FIRPTA withholding but is the BUYER who acts as the "withholding agent" so is buyer's responsibility to make sure the money is sent to the IRS on time.

If you have questions on this very sensitive topic do not hesitate to give us a call, we will be glad to assist you, or even better, schedule your FIRPTA for Escrow class via Zoom, Teams or any other platform, we'd love to be a resource for you.

------------------------------

Mary Enzi

Tax Solutions – FIRPTA Consulting

Barker TX

+1 (281) 578-1040

[email protected]

Original Message:

Sent: 08-07-2023 11:56

From: Mary Enzi

Subject: FIRPTA - Thank you for all your calls - Keep them coming!!

Good Morning ALTA members; I hope you had a great weekend !!

We received over 10 calls from some of you last week, I am so excited to be able to answer your questions and handle your FIRPTA transactions!!! :)

We were asked to handle a couple of not last minute but more like "last second" FIRPTA transactions last week which we can do, but remember a rush fee is included on top of our regular fee, however, I would like to take this opportunity to explain a little bit about the "behind the scenes" of FIRPTA.

You would think FIRPTA is about to complete a couple of IRS forms and that's it, well is not, there is so much more than that, in 99.99% of the cases the seller and buyer have not been informed by their real estate agents about this "extra step" in the property's sale/purchase and as is expected both parties have questions, especially seller, FIRPTA withholding is 15% (could be reduced to 10%) of the listing price, not the gain, not the price after costs, the listing price, so it is a good chunk of money that has to be withheld and sent to the IRS, the seller wants to recover that money because again, FIRPTA IS A WITHHOLDING NOT A TAX, so there is a lot of explaining to do to many different people, sometimes multiple sellers are involved, some in different countries with obvious different time zones, is morning here but is late afternoon of night where the other seller(s) are etc... sometimes we have to hire someone that speaks the language the seller speaks so there is a better understanding of the process and in almost all FIRPTA transactions there is the need of a U.S. tax ID, we are CAA (Certified Acceptance Agents), licensed by the IRS, we can certify passports so the foreign seller doesn't have to send the original passport to IRS for over 16 weeks,

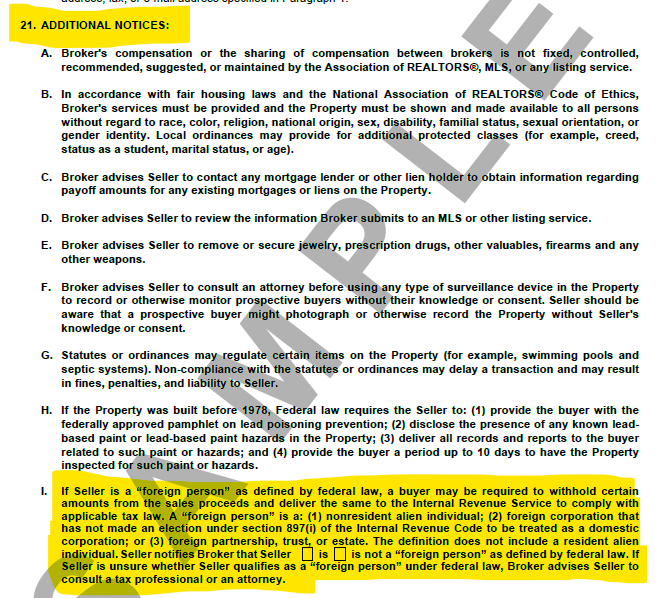

In TX, the listing agreement talks about FIRPTA (or "if the seller is foreign") in paragraph 21 - sub paragraph I

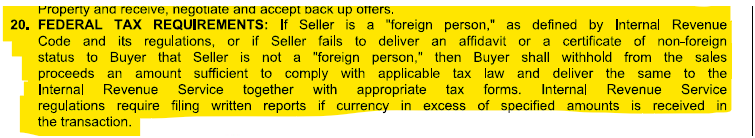

And the TREC contract talks about FIRPTA again in paragraph 20

In addition, we have to have FIRPTA datasheets to complete, signed engagement agreement and request that the title company includes our fees in the settlement statement because that is how our fee gets paid.

We can work on last minute FIRPTA transactions but is best if we have at least 5 days to explain, compile information, documents, talk to all parties involved and complete the necessary forms, remember some forms HAVE to be sent the day of the closing, so is important that we have time to review everything before send documents to IRS.

Again, please do not hesitate to reach out to us should you have questions, I can assure you, you have more FIRPTA transactions than you imagine.

Have a great week, and keep us in mind for all your FIRPTA and federal tax questions.

------------------------------

Mary Enzi

Tax Solutions – FIRPTA Consulting

Barker TX

+1 (281) 578-1040

[email protected]

------------------------------