Hello All

As a result of all the confusion and controversy surrounding the electronic filing of 1099's many of you called our office asking, among others, one particular question.

What do I do if I don't have a TIN to include on a 1099-S?

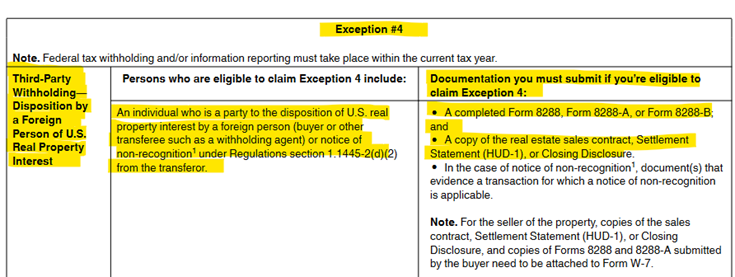

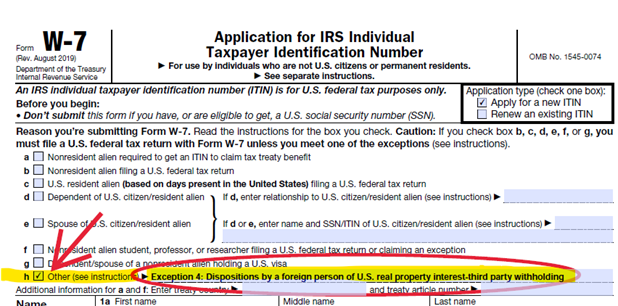

The IRS has guidelines to issue an ITIN and the W7 application has to go with supporting documents indicating the "exception/reason" for applying we are using,

https://www.irs.gov/pub/irs-pdf/iw7.pdf

Example;

The rules are clear as to what documents need to go with the application.

When dealing with a foreign seller is common that those individuals do not have a U.S. tax ID whether is an ITIN or a SSN.

My suggestion is to request the real estate agent or the seller(s) to apply for ITIN with the documents mentioned on the IRS website (here above) at the moment of closing, after 8 to 16 weeks they can provide you with the number the IRS issued for them, the need to file any income forms such as, but not limited to 1099-Misc, 1099-NEC 1099-S is not accepted by the IRS to process an ITIN. Make sure you instruct your clients to seek the services of a CAA (Certified Acceptance Agent) when sending a W7 application so you have the necessary information when the time to file 1099-S comes again next year.

------------------------------

Mary Enzi CAA

Tax Solutions – FIRPTA Consulting

[email protected]

+1 (281) 578-1040

Barker TX

------------------------------